Tuesday, August 9, 2022, the Lancaster Chamber and the Lancaster Economic Development Company were honored to host the PA Chamber along with several local legislators and business community leaders for a roundtable discussion and press conference to discuss and celebrate the CNI (Corporate Net Income) Tax Rate reduction and the positive effect it will have on the business community in Lancaster County. Read more below:

PRESS RELEASE

| FOR IMMEDIATE RELEASE | |

| August 9, 2022 | For More Information, Contact: Lindsay Andrews, Director of Members Communications (717) 720.5435 |

PA Chamber, Business Leaders Applaud State Lawmakers, Wolf Administration for Improving PA’s Competitiveness With Bipartisan Tax Reform Package

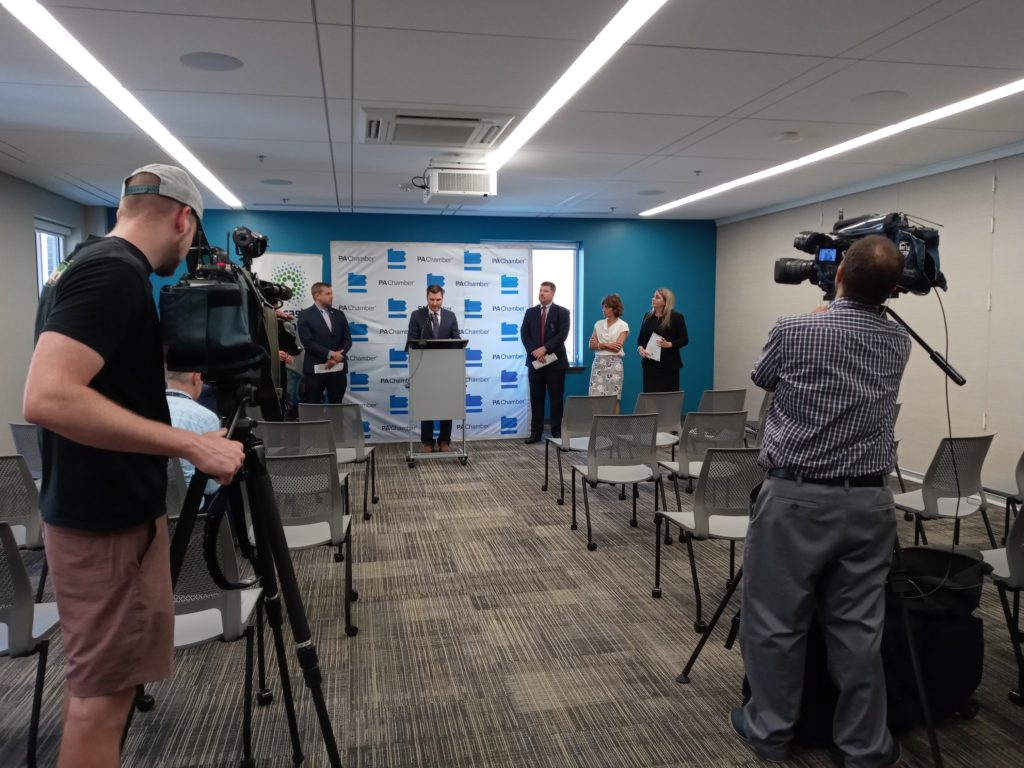

The PA Chamber welcomed members of the Lancaster state legislative delegation, representatives from the Wolf administration and state and local business leaders today for a business roundtable and press conference at the Lancaster Chamber of Commerce that focused on how Pennsylvania’s recently enacted state tax reform package will improve Pennsylvania’s competitiveness and chart a new course for the Commonwealth’s economy.

“We’re here as proof that with bipartisan collaboration and a strong partnership between the public and private sector, we can accomplish great things for the Commonwealth,” PA Chamber President and CEO Luke Bernstein said. “This tax reform package is an important first step in driving Pennsylvania’s competitiveness in a forward direction and showing the world that we’re open for business. We thank the Wolf administration and the General Assembly for prioritizing these much-needed changes to the state’s tax structure. Working Together for PA, we look forward to building on this momentum to help Pennsylvania realize its true economic potential.”

“These reforms to Pennsylvania’s tax code are a major step in making the Commonwealth more competitive, encouraging our businesses to expand, and bringing more investment and opportunity to the state,” said Heather Valudes, President and CEO of the Lancaster Chamber. “We know Lancaster County is a wonderful place to live – with a more competitive tax code, our region will also be an even better place to start a business. We are pleased to have worked with the Lancaster County legislative delegation, the governor’s office and state business leaders to make these much needed reforms a reality.”

The tax reform package – which was enacted as part of the 2022-23 budget agreement – includes a long overdue reduction to the state’s Corporate Net Income Tax rate from 9.99 percent to 4.99 percent – cutting it in half over the course of nine years. Based on current state corporate tax rates, once the law is fully implemented, Pennsylvania will go from imposing one of the nation’s highest CNIT tax rates, to the 8th lowest in the country.

Said Rep. Bryan Cutler, Speaker of the House (R-100), “It is more important than ever to make sure our job creators have an environment to thrive and push back on the impacts of inflation. As we heard from leaders in Lancaster County today, the steps this budget takes are just the beginning, and I look forward to continuing to work to turn the tide of inflation to help Pennsylvanians in all corners of the Commonwealth.”

“Improving our tax structure and business climate in Pennsylvania will have a ripple effect across every community and job sector by creating more high-paying jobs, enabling working class Pennsylvanians to experience earned success and upward mobility, and allowing our Commonwealth to compete nationally and globally for economic opportunity,” said Sen. Ryan Aument (R-36).

The benefits of a more competitive business tax code go far beyond improving the state’s business climate. Studies have shown that decreasing the CNIT leads to increased GDP, higher wages and increased home values, all of which create family sustaining jobs and attract and retain new talent.

The tax package also includes relief for small businesses that the PA Chamber has long sought for its members, affording businesses the opportunity to defer personal income tax liabilities through “like-kind exchanges” of certain property. This provision allows employers to invest in the job-creating assets businesses need to stay competitive. Previously, Pennsylvania was the only state in the country that did not offer this type of deferral. An additional component of the package aligns the state Tax Code with federal tax law by allowing small businesses to deduct qualifying equipment purchases from personal income tax liabilities, just as federal tax law provides for under Section 179. This change makes it easier for employers to buy equipment and invest, which in turn promotes job growth.

“Small businesses are the backbone of our economy and we’re pleased that this tax reform package includes significant measures to incentivize investment by small businesses in the state,” said Lisa Riggs, President of the Economic Development Company of Lancaster County. “Our team works hard every day to expand opportunity in our region, and these reforms give us a greater ability to make that happen. By putting Pennsylvania on track to be more competitive than other states in the region on tax policy, Lancaster County’s small businesses and entrepreneurs can focus on investing in their people, operations and communities.”

These important updates to the state’s tax structure will improve Pennsylvania’s competitiveness by bringing the Commonwealth in line with other states and federal tax law and leveling the playing field for entrepreneurs looking to start a business here.

“Our goal with the Governor’s Action Team and the Department of Community and Economic Development is to champion new and expanded investment and opportunity in this state,” said Brent Vernon, Executive Director for the Governor’s Action Team. “We are proud to have worked with the PA Chamber and legislators on both sides of the aisle to accomplish these monumental changes and make Pennsylvania an even better place to do business. Our state is open for business, and we look forward to taking this message to entrepreneurs and business leaders across the country and around the world.”

not secure